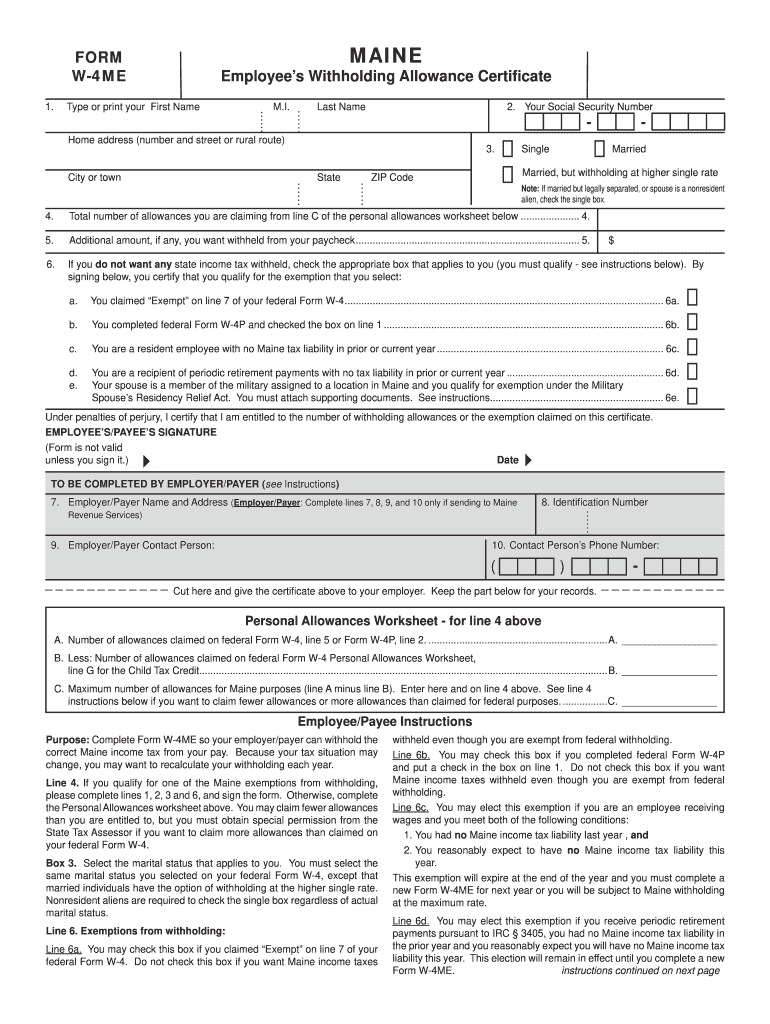

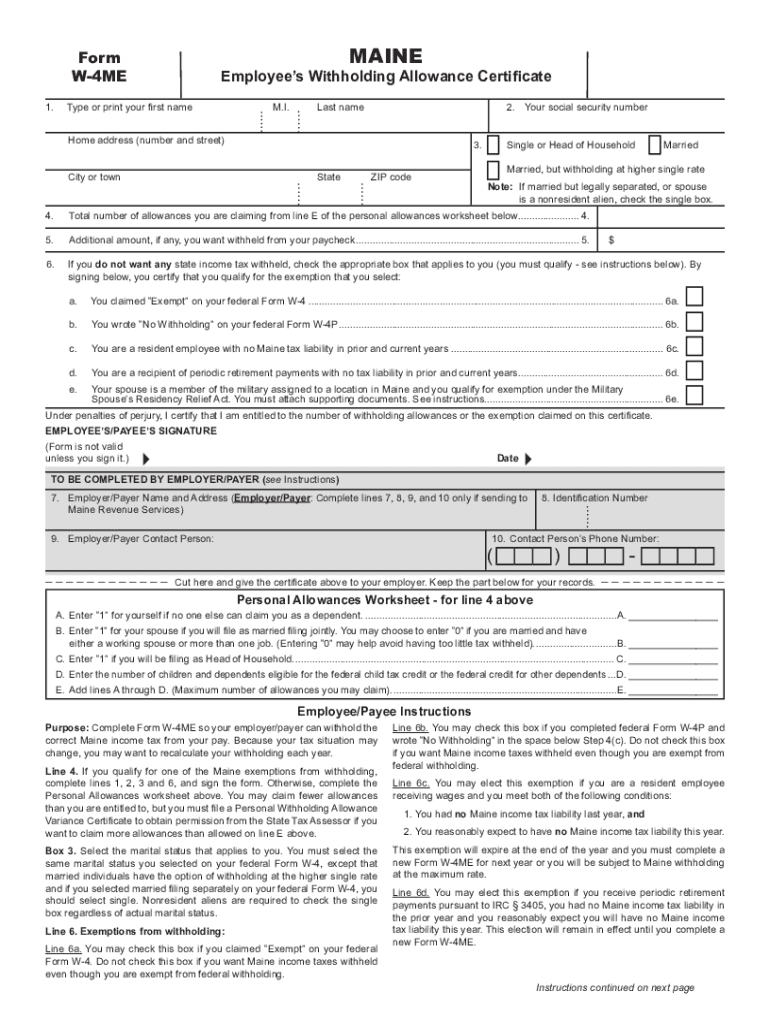

Maine W-4 Form 2025. Usually, you’ll receive a paper copy. The internal revenue service requires all employees who claimed total exemption from federal income taxes in calendar year 2025 to refile a.

If you are not required to withhold maine income tax, but have made payments which are taxable to maine, you may, as a courtesy, withhold and remit maine income tax. The value of a state allowance in the percentage method is $5,000,.

Maine w4 Fill out & sign online DocHub, Then, complete steps 1(a), 1(b), and 5. If you googled, “should i claim 0.

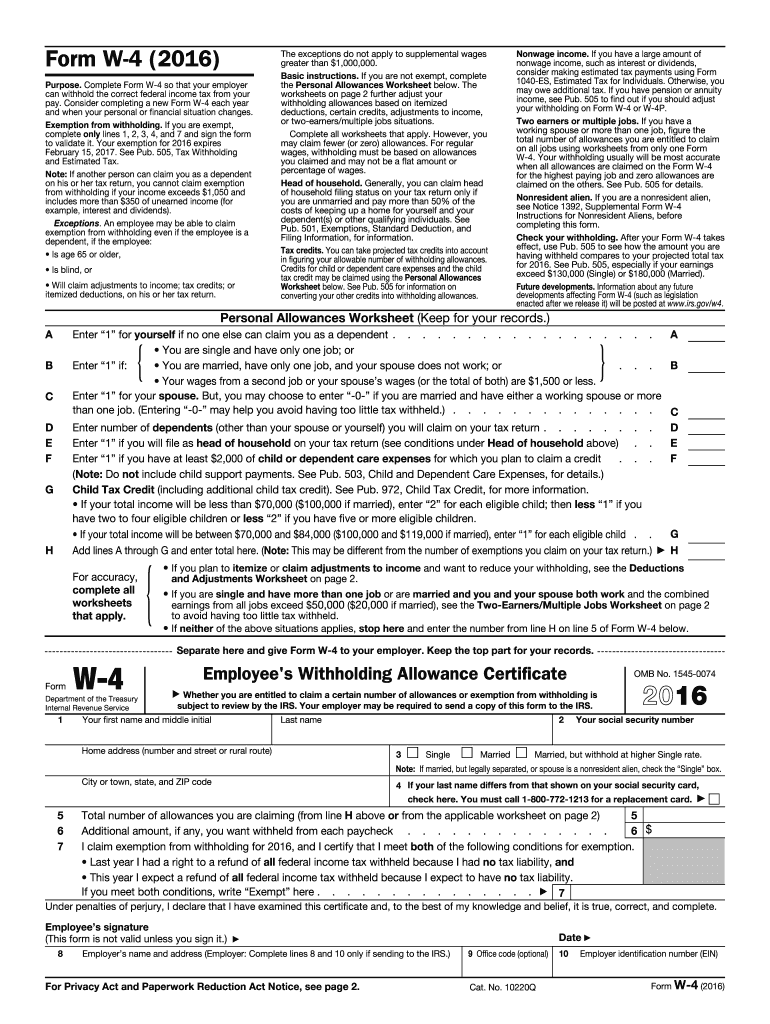

What Is the W4 Form and How Do You Fill It Out? Simple Guide SmartAsset, If you are filing as the head of the household, then you would also claim 1 allowance. Maine state income tax tables in 2025.

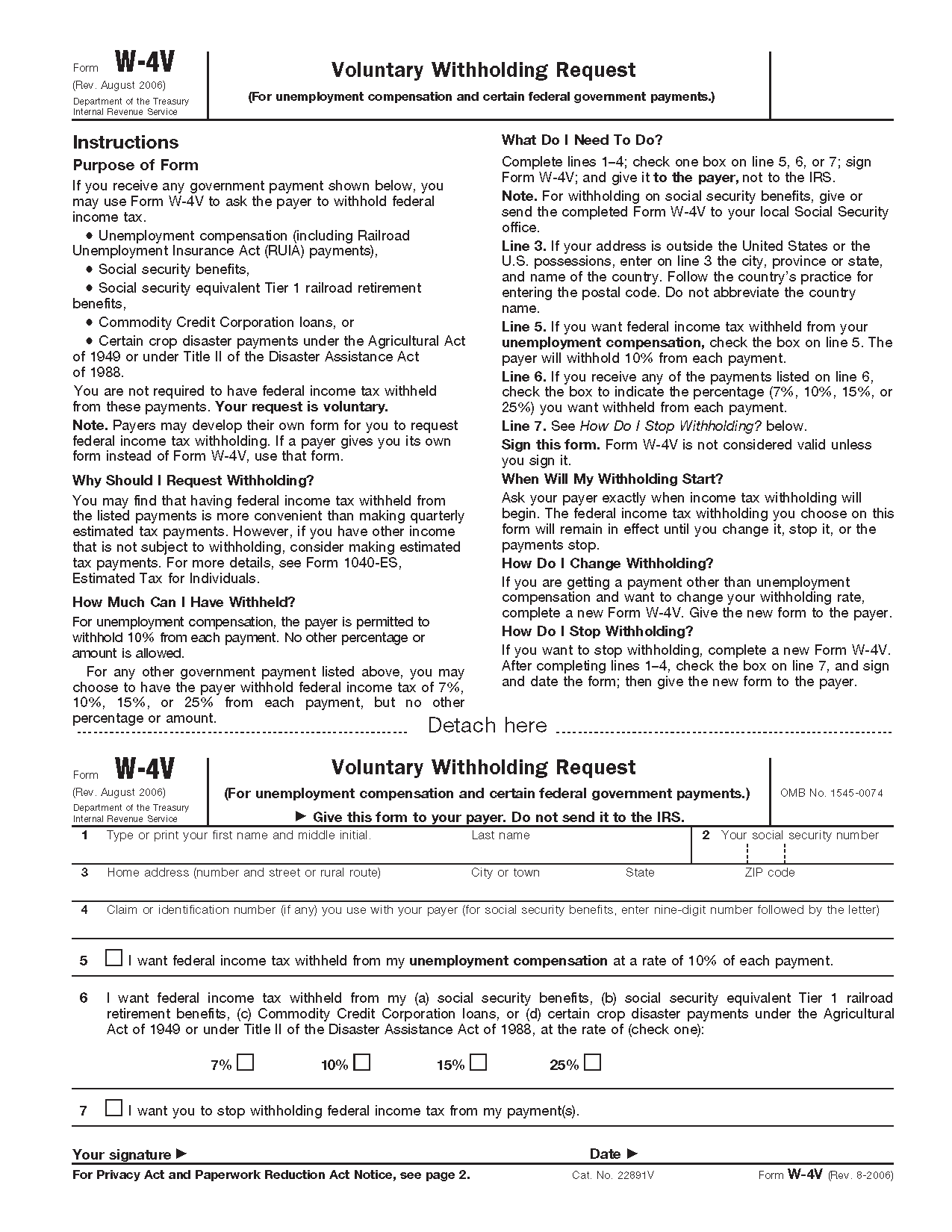

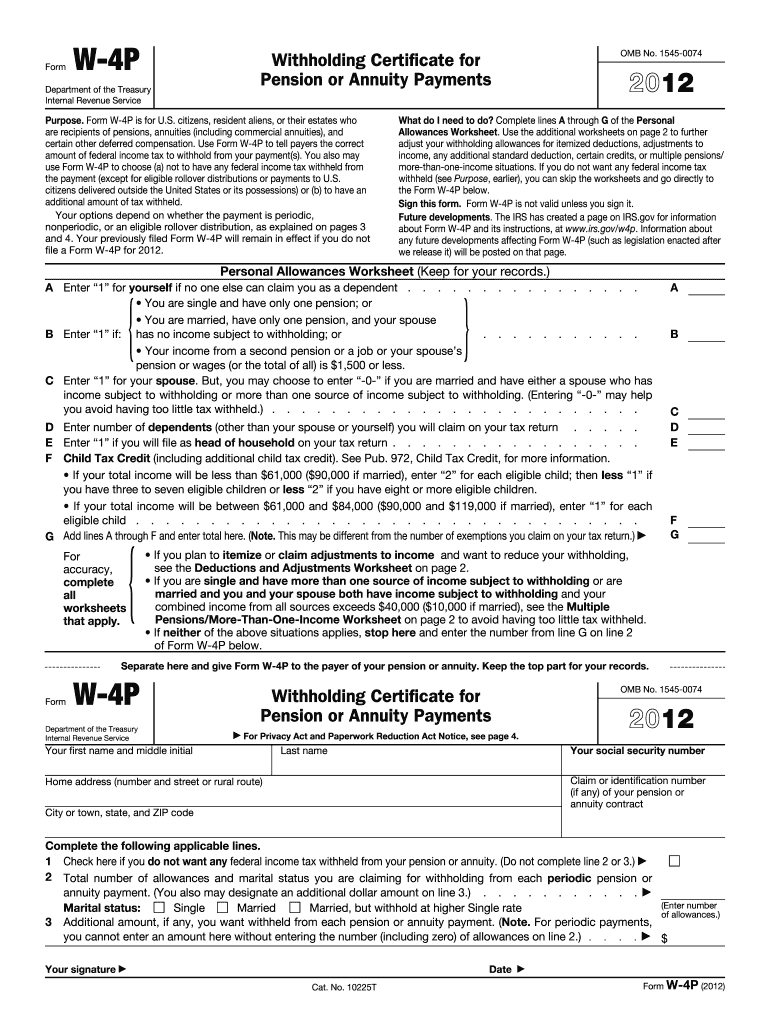

Can You Change Social Security Tax Withholding Online 20182024 Form, Instructions for using the irs’s tax withholding estimator. Employees who have not had significant life.

Printable Form W 4 Printable Forms Free Online, Usually, you’ll receive a paper copy. Then, complete steps 1(a), 1(b), and 5.

W4 form 2016 Fill out & sign online DocHub, You will likely be getting a. It works similarly to a.

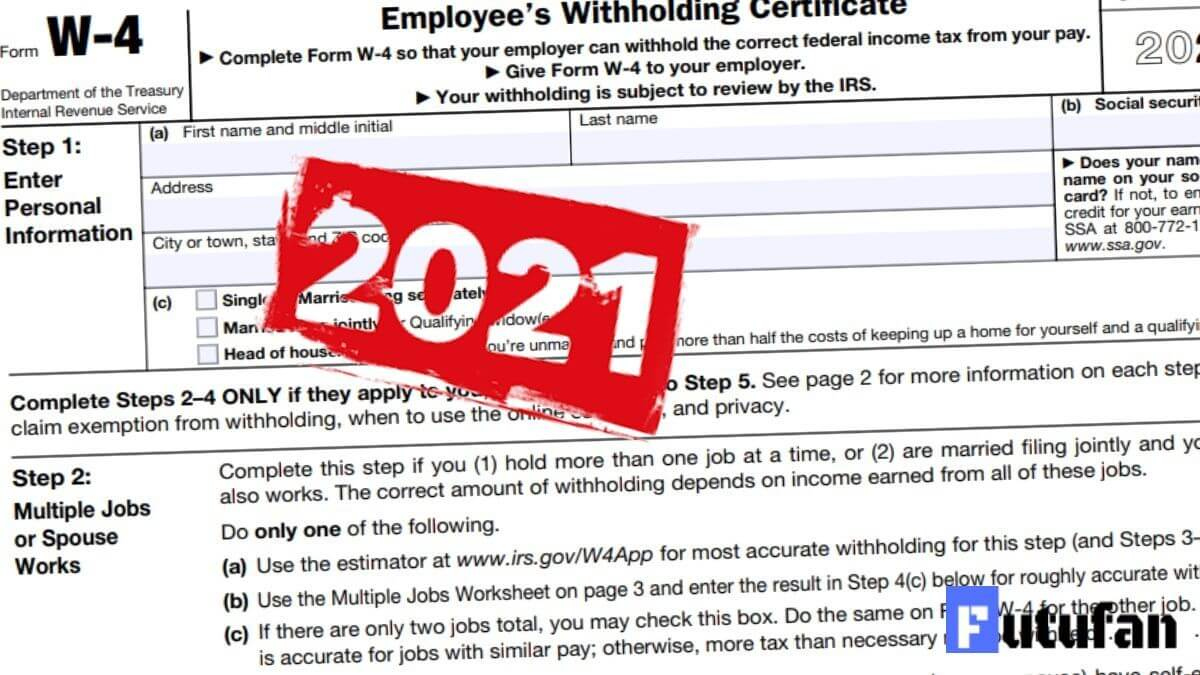

W4 2025 Printable Maine 2025 W4 Form, If you googled, “should i claim 0. Instructions for using the irs’s tax withholding estimator.

Maine w4 Fill out & sign online DocHub, 2025 tax exemption w‑4 deadline. Unless changes are required, employees.

How to Fill Out Your W4 Form in 2025 (2025), If you are filing as the head of the household, then you would also claim 1 allowance. Usually, you’ll receive a paper copy.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

Additional amount withheld Fill out & sign online DocHub, 14 by maine revenue services. It works similarly to a.

Fillable W 4 Form Printable Forms Free Online, Usually, you’ll receive a paper copy. Instructions for using the irs’s tax withholding estimator.

The internal revenue service requires all employees who claimed total exemption from federal income taxes in calendar year 2025 to refile a.